Lend responsibly, lowering default risk and optimize field checks

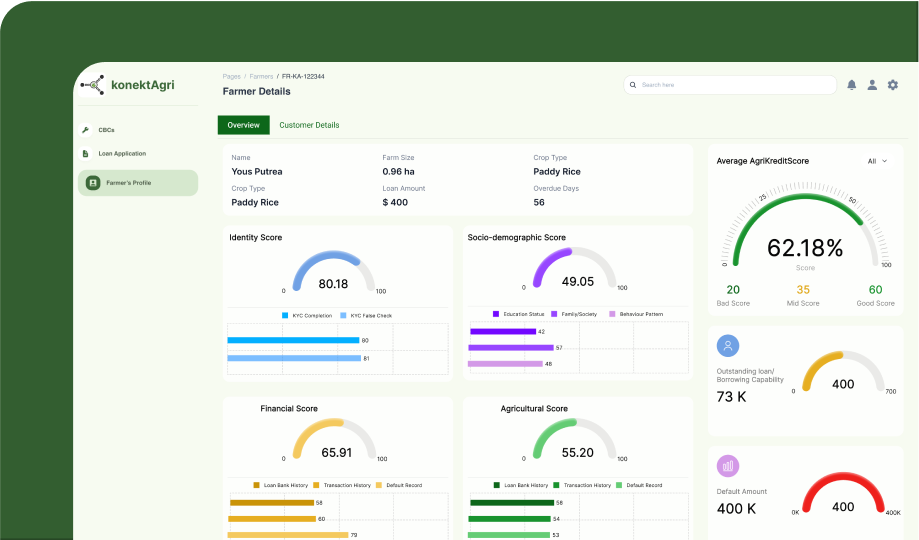

We combine financial, behavioural & farm data to provide farmer credit scores, lowering lender risk and farmer cost of credit

Book DemoWe enable lenders to

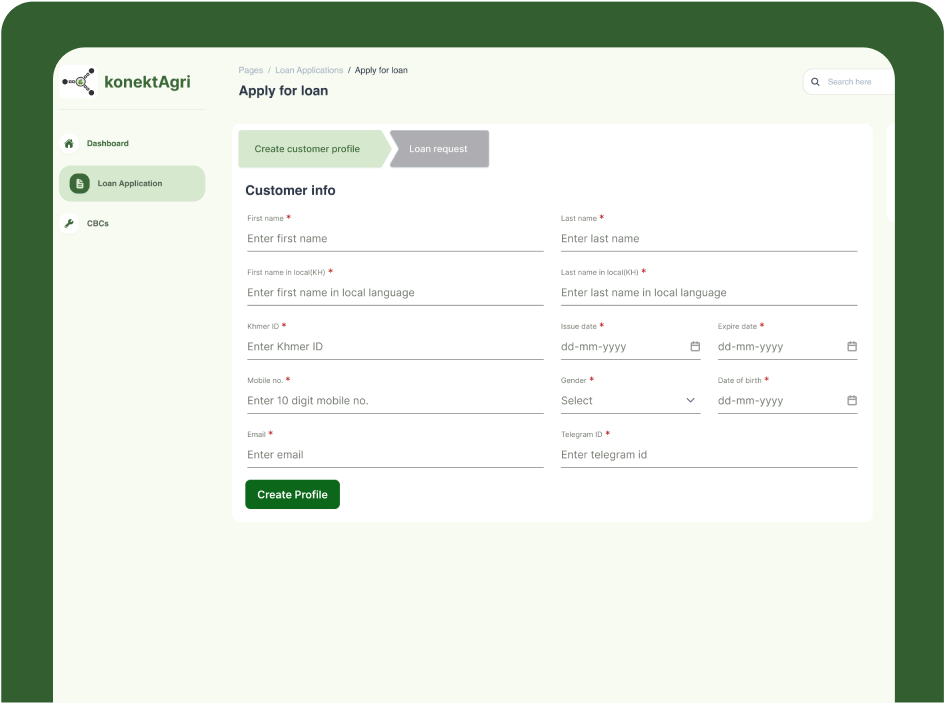

Assess loan applications

Combine traditional financial history with satellite-based farm progress to offer scores.

Monitor farms

Monitor customer farms, optimize field visits and intervene early

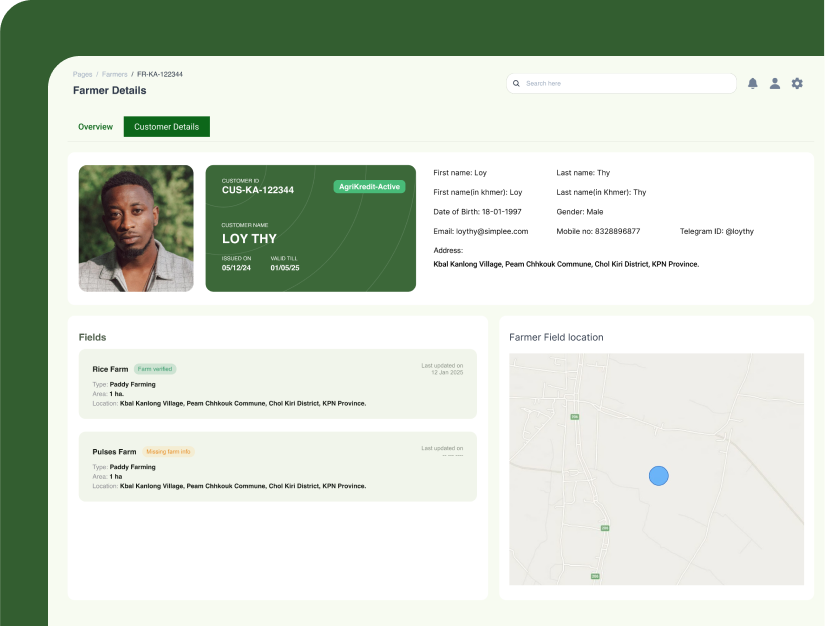

Onboard customers

Simplify customer onboarding, including geotagging capability with a secure, centralized platform.

Conduct eKYC

Farmer ID / liveness checks via CamDX database

Geotag farms

User-friendly, minimizing number of clicks

Why adopt data-based lending?

Traditional lending that is based on collateral has caused high interest rates for farmers due to the risk of losing lump sum and high operational cost for lender.

Lending based on data-driven solution can:

- Decrease default rate for lender

- Accurately check farmer creditworthiness

- Reduce operational cost

- Easily monitor farmer progress

- Early intervention in case of emergency

Our partners

Our platform places farmers at its core but also benefits other stakeholders such as financial institutions, suppliers, farming businesses, and buyers.

Farmer

Microfinance institutions

Bank

Insurance companies

Agricultural suppliers

Commodity buyers

Focusing on the agricultural community, konektAgri directly impacts at least 7 sustainable development goals